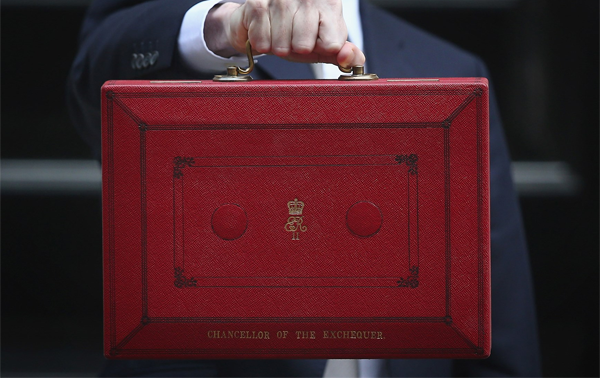

Autumn Budget 2017

How does the Budget affect Northern Ireland businesses?

The Chancellor, Philip Hammond, delivered his Budget statement on Wednesday 22 November 2017. We have summarised the key points from the Budget and specific issues affecting Northern Ireland businesses.

Forecasts

Growth forecast

- 1.5% in 2017

- 1.4% in 2018

- 1.3% in 2019

- 1.3% in 2020

- 1.5% in 2021

- 1.6% in 2022

Government borrowing forecast:

Borrowing is due to be £49.9 billion in 2017-18, fall to £39.5 billion in 2018-19 and forecast to be £25.6 billion in 2022-23.

Debt forecast:

- 86.5% of GDP in 2017-18

- 86.4% of GDP in 2018-19

- 86.1% of GDP in 2019-20

- 83.1% of GDP in 2020-21

- 79.3% of GDP in 2021-22

- 79.1% of GDP in 2022-23

Unemployment

There are currently 1.4 million people out of work and the Office for Budget Responsibility (OBR) forecast that 600,000 more people will be in work by 2022.

Northern Ireland specific announcements

An additional funding of almost £660 million for the Northern Ireland Executive.

The government will review the effect of VAT and Air Passenger Duty on tourism in Northern Ireland – this will be reported on at next year’s Budget.

Upon restoration of a Northern Ireland Executive, the government will open negotiations for a city deal for Belfast as part of the government’s commitment to work towards a comprehensive and ambitious set of city deals across Northern Ireland to boost investment and productivity.

Brexit

£3 billion has been set aside to plan for Brexit over the next two years – £1.5 billion will be made available in each of 2018-19 and 2019-20.

Income tax

The personal allowance will rise to £11,850 from April 2018 and £46,350 for the higher rate threshold.

National Living Wage and National Minimum Wage rates

The National Living Wage rate will increase to £7.83 per hour from April 2018. The National Minimum Wage will also increase from April 2018 to:

| 21 to 24 year olds | 18 to 20 year olds | 16 and 17 year olds | Apprentices |

|---|---|---|---|

| £7.38 per hour | £5.90 per hour | £4.20 per hour | £3.70 per hour |

VAT

The VAT registration threshold will remain at £85,000 for the next two years. See registering for VAT. The government will consult on whether its design could better incentivise growth. Measures to deal with online VAT evasion by strengthening and extending existing powers that make online marketplaces responsible for the unpaid VAT of their sellers.

Duties

Vehicle Excise Duty for diesel cars that don’t meet the latest emissions standards will go up by one band from April 2018 and the existing diesel supplement in Company Car Tax will increase by 1%. This is specifically for cars and does not apply to vans or lorries.

Fuel duty will remain frozen.

Tobacco duty will rise by inflation plus 2% and 1% for hand rolling tobacco.

Plans to increase alcohol duty for high strength alcohol including some ciders from 2019. Duty on other ciders, beer, wine and spirits have been frozen.

Air Passenger Duty will be frozen for all economy passengers and all short-haul flights. It will rise for premium fares on long-haul flights, and on private jets.

Infrastructure

£500 million to be invested in 5G fibre broadband and artificial intelligence. A new £400m charging infrastructure fund to be established, investing an extra £100 million in Plug-In-Car Grant, and £40 million in charging R&D.

Stamp Duty

Stamp Duty has been abolished with effect from today for all first-time buyer purchases for properties up to the value of £300,000. First-time buyers of homes worth between £300,000 and £500,000 will not pay stamp duty on the first £300,000.

Business rates

A number of changes for business rates were announced but these do not apply to Northern Ireland.

Tax on intellectual property

From April 2019 the government will apply income tax to royalties relating to UK sales, when those royalties are paid to a low tax jurisdiction.

Environment

The government will investigate how the tax system and charges on single-use plastic items can help reduce waste.

Universal Credit

Removal of the seven day waiting period applied at the beginning of a benefit claim so that entitlement to Universal Credit will start on the day of the claim. The advances system will be changed to ensure that any household that needs it can access a full month’s payment within five days of applying for it. The repayment period for advances will be extended from 6 months to 12 months. Any new Universal Credit claimant in receipt of Housing Benefit, will continue to receive it for two weeks.

Read full details on the Autumn Budget 2017.

Source: nibusinessinfo.co.uk