Budget 2018

How does the Budget affect Northern Ireland businesses?

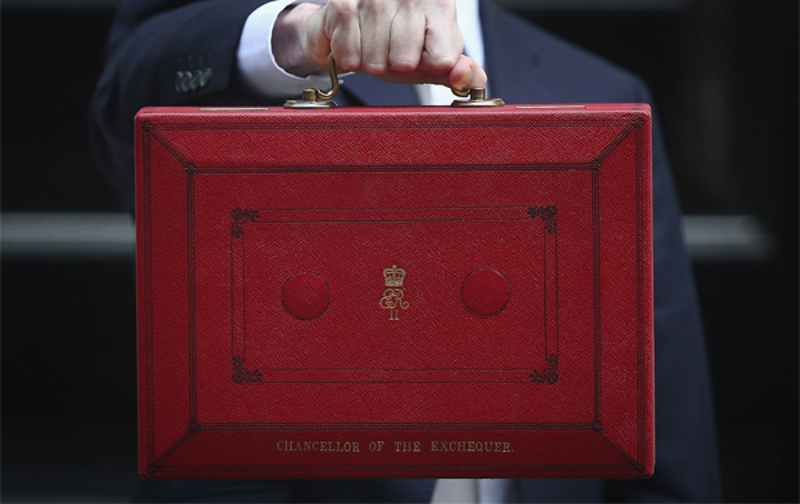

The Chancellor, Philip Hammond, delivered his Budget statement on Monday 29 November 2018. We have summarised the key points from the Budget and specific issues affecting Northern Ireland businesses.

Forecasts

Growth forecast

- 1.3% in 2018

- 1.6% in 2019

- 1.4% in 2020

- 1.4% in 2021

- 1.5% in 2022

- 1.6% in 2023

Government borrowing forecast

Government borrowing this year will be £11.6 billion lower than forecast at the Spring Statement. It is then set to fall from £31.8 billion in 2019/20 to £26.7 billion in 2020-21, £23.8 billion in 2021/22, £20.8 billion in 2022/23 and £19.8 billion in 2023/24.

Debt forecast:

- 83.7% of GDP in 2018-19

- 82.8% of GDP in 2019-20

- 79.7% of GDP in 2020-21

- 75.7% of GDP in 2021-22

- 75.0% of GDP in 2022-23

- 74.1% of GDP in 2023-24

Northern Ireland specific announcements

An additional funding of almost £320 million for the Northern Ireland Executive to 2020-21.

City Deals in Northern Ireland – £300 million will be provided for a Belfast City Region Deal. The government will work with local partners to progress the deal, including establishing governance, accountability and transparency arrangements, to ensure this can be spent in the absence of a Northern Ireland Executive. The government will also begin formal negotiations with local partners towards a Derry/Londonderry and Strabane City Region Deal.

Shared and integrated education and shared housing in Northern Ireland – the government will move forward with projects worth £350 million as part of the Fresh Start Agreement.

Belfast regeneration funding – £2 million will be provided for the recovery and regeneration of Belfast City Centre following a fire at the Bank Buildings in August.

Brexit

£2.2 billion has been allocated to departments for Brexit preparations, and a further £2 billion will be allocated for 2019-20.

Income tax

The personal allowance will rise to £12,500 from April 2019 and £50,000 for the higher rate threshold. See income tax rates and personal allowances.

The National Living Wage rate will increase to £8.21 per hour from April 2019. See National Living Wage rates.

New Digital Services Tax

A UK Digital Services Tax will be introduced. It is not an online sales tax on goods bought online, but will only be paid by profitable firms that have at least £500 million a year in global revenues.

There will be a consultation first before the tax comes into effect in April 2020.

VAT

The VAT registration threshold will remain at £85,000 until April 2022. See registering for VAT.

Duties

Fuel duty will remain frozen.

Tobacco duty will rise by inflation plus 2% and 1% for hand rolling tobacco. These changes will come into effect from 18:00 on 29 October 2018.

Duty on other ciders, beer, wine and spirits will remain frozen.

Stamp Duty

The Government will extend the stamp duty relief for first-time buyers to purchases of shared ownership properties worth up to £500,000. Taxpayers who have bought homes that would have qualified since the last Budget in November 2017 will be able to claim a refund.

Infrastructure

A strategic roads investment package will be introduced. There will also be a nationwide rollout of digital infrastructure. Overall, by 2021 the government will be investing £9 billion a year more in infrastructure than in 2015.

Environment

A new tax will be introduced from April 2022 on plastic packaging which does not contain 30% recyclable material.

Read full details on the Budget 2018.

Source: nibusinessinfo.co.uk